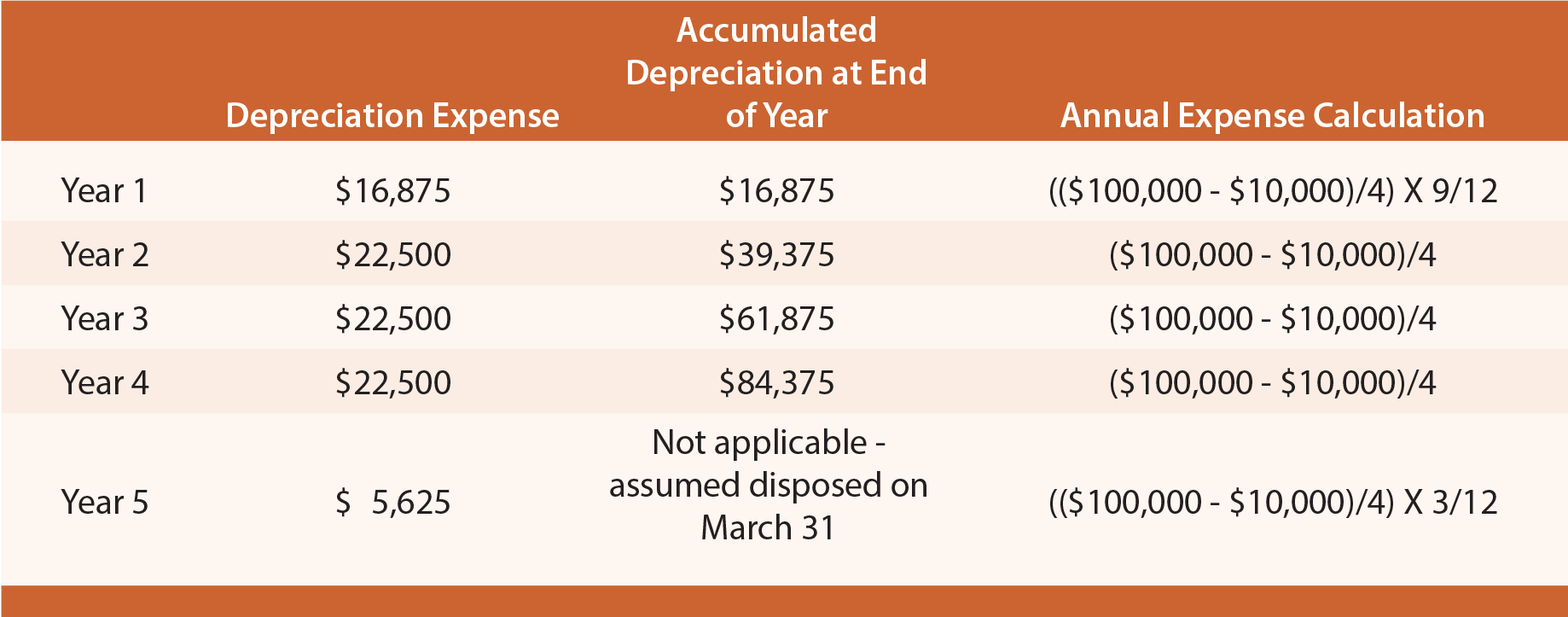

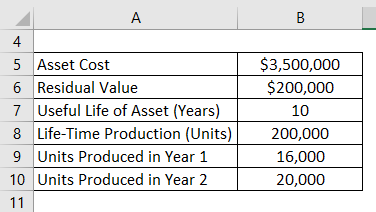

Depreciation calculation example

Depreciation is the amount the company allocates. The formula for this type of depreciation is as follows.

Depreciation Formula Examples With Excel Template

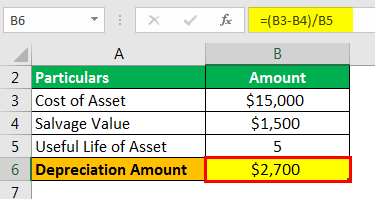

Determine the cost of the asset.

. Once calculated companies use the same rate for each asset in that class. Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable. IRS defines depreciation as a technique of income tax deduction that aids companies recover the asset costs.

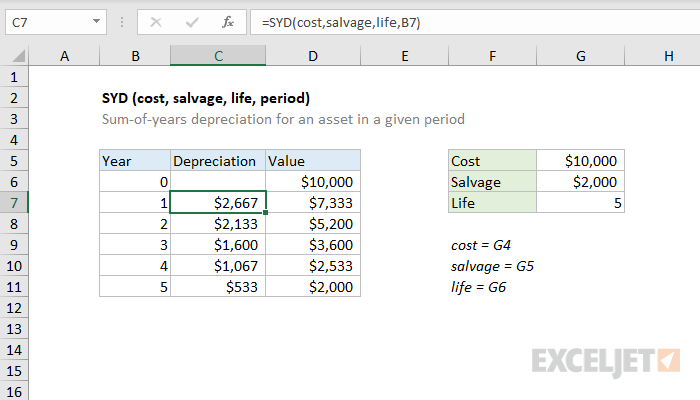

Annual depreciation cost residual value year of useful life. Suppose if the cost of a motor is rs20 000 its useful life is 4 years and scrap value is Rs2000 the annual. A Sample Depreciation Calculation.

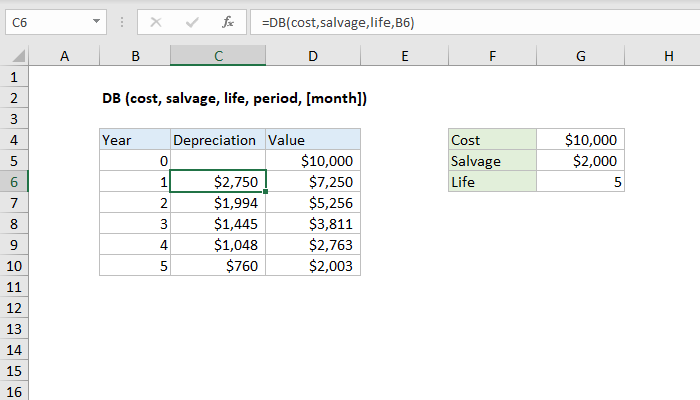

Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear. Since it is a special type of depreciation it is not the same as the subsequent years depreciation. Depreciation rate 1 Assets useful life x 100.

Double declining depreciation 2 x straight-line depreciation rate x value at the start of the year Example. In this case the depreciation rate in the declining balance method can be determined by multiplying the straight-line rate by 2. This rate then goes into various depreciation.

For instance a widget-making machine is said to depreciate. The straight line calculation steps are. Bonus Depreciation is calculated by using the bonus rate which is prevailing in the market.

In this insurance depreciation example the thing was damaged when it was 2 years old and currently costs 250 dollars to replace including tax and. For example if the fixed assets useful life is 5 years then. Depreciation recapture Accumulated depreciation.

The accumulated depreciation is taxed as ordinary income and the remaining amount in the realized gain is taxed as a capital gain.

Depreciation Formula Calculate Depreciation Expense

Depreciation Methods Principlesofaccounting Com

Depreciation Formula Examples With Excel Template

Straight Line Depreciation Formula And Calculation Excel Template

Depreciation Formula Calculate Depreciation Expense

How To Use The Excel Db Function Exceljet

Declining Balance Depreciation Double Entry Bookkeeping

Depreciation Calculation

How To Use The Excel Syd Function Exceljet

Depreciation Rate Formula Examples How To Calculate

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Examples With Excel Template

Depreciation Rate Formula Examples How To Calculate

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

Depreciation Formula Calculate Depreciation Expense

Annual Depreciation Of A New Car Find The Future Value Youtube

Depreciation Expense Double Entry Bookkeeping